Highest Mill Rate In Maine . estimated full value property tax (mill) rates for maine cities, towns, and plantations. Rates are for 2022 and are. The county’s average effective property tax rate is 1.65%. The good news the old town. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. As many of you probably already. androscoggin county has the highest property tax rate in the state of maine. the mill rate went down form 21 to 17. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. It’s pretty fascinating to see the growth rate over the past several years.

from vi.fontana.wi.gov

Rates are for 2022 and are. It’s pretty fascinating to see the growth rate over the past several years. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The county’s average effective property tax rate is 1.65%. As many of you probably already. the mill rate went down form 21 to 17. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. androscoggin county has the highest property tax rate in the state of maine. full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. The good news the old town.

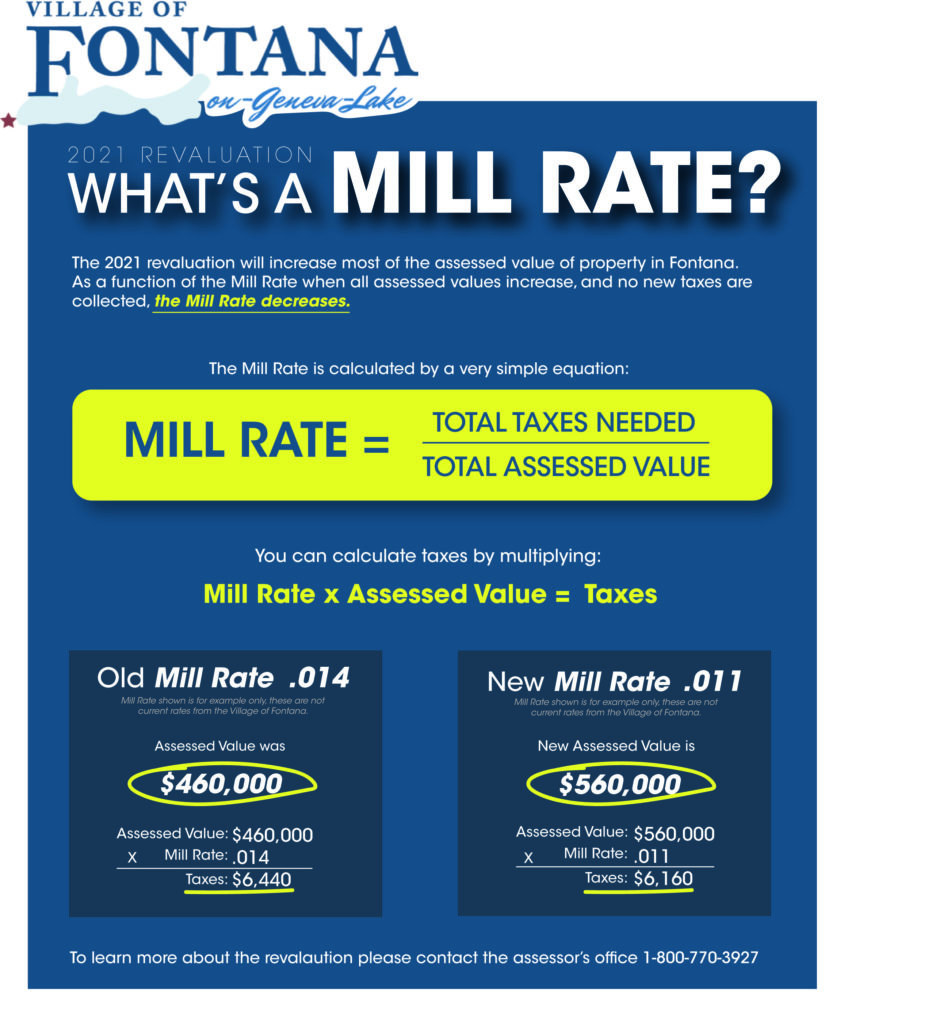

What Is A Mill Rate? Village of Fontana

Highest Mill Rate In Maine state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The county’s average effective property tax rate is 1.65%. full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. As many of you probably already. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. Rates are for 2022 and are. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. It’s pretty fascinating to see the growth rate over the past several years. The good news the old town. androscoggin county has the highest property tax rate in the state of maine. the mill rate went down form 21 to 17. estimated full value property tax (mill) rates for maine cities, towns, and plantations.

From downeast.com

Four Questions for the Author of "Mill Town" Down East Magazine Magazine Highest Mill Rate In Maine estimated full value property tax (mill) rates for maine cities, towns, and plantations. Rates are for 2022 and are. The county’s average effective property tax rate is 1.65%. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. access valuable information on maine's property tax rates and assessments with. Highest Mill Rate In Maine.

From www.40mile.ca

Assessment and Taxation Highest Mill Rate In Maine The county’s average effective property tax rate is 1.65%. It’s pretty fascinating to see the growth rate over the past several years. As many of you probably already. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. the mill rate went down form 21 to 17. androscoggin county. Highest Mill Rate In Maine.

From www.mycrestonnow.com

mill rates My Creston Now Highest Mill Rate In Maine access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. As many of you probably already. It’s pretty fascinating to see the growth rate over the past several years. The county’s average effective property tax rate is 1.65%. androscoggin county has the highest property tax rate in the state. Highest Mill Rate In Maine.

From kmscompass.com

Our own assessment, of Mill Rates — KMS Team at COMPASS Highest Mill Rate In Maine As many of you probably already. The county’s average effective property tax rate is 1.65%. The good news the old town. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. androscoggin county has the highest property tax rate in the state of maine. estimated full value property. Highest Mill Rate In Maine.

From www.researchgate.net

Average Statewide Millage Rates Download Table Highest Mill Rate In Maine It’s pretty fascinating to see the growth rate over the past several years. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The county’s average effective property tax rate is 1.65%. As many of you probably already. estimated full value property tax (mill) rates for maine cities, towns, and. Highest Mill Rate In Maine.

From www.investopedia.com

Mill Rate Definition Highest Mill Rate In Maine estimated full value property tax (mill) rates for maine cities, towns, and plantations. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The good news the old town. The county’s average effective property tax rate is 1.65%. Rates are for 2022 and are. As many of you probably already.. Highest Mill Rate In Maine.

From batubuayabradleys.blogspot.com

Mill Rate Tax Calculator Highest Mill Rate In Maine the mill rate went down form 21 to 17. Rates are for 2022 and are. estimated full value property tax (mill) rates for maine cities, towns, and plantations. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The county’s average effective property tax rate is 1.65%. As many. Highest Mill Rate In Maine.

From patch.com

Connecticut Property Taxes 202324 TownByTown, Who Pays The Most Highest Mill Rate In Maine Rates are for 2022 and are. estimated full value property tax (mill) rates for maine cities, towns, and plantations. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. The good news the old town. the mill rate went down form 21 to 17. full value tax. Highest Mill Rate In Maine.

From vi.fontana.wi.gov

What Is A Mill Rate? Village of Fontana Highest Mill Rate In Maine state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. It’s pretty fascinating to see the growth rate over the past several years. The good news the old town. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. the. Highest Mill Rate In Maine.

From patch.com

Lowest and Highest Mill Rates in Connecticut How Did Your Town Do Highest Mill Rate In Maine access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. The good news the old town. full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. It’s pretty fascinating to see the growth rate over the past several years. the mill rate. Highest Mill Rate In Maine.

From jvhomes.typepad.com

Dane County Mill Rates Hows The Market Madison Highest Mill Rate In Maine state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. the mill rate went down form 21 to 17. The good news the old town. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. As many of you probably. Highest Mill Rate In Maine.

From www.youtube.com

How to calculate millage rate YouTube Highest Mill Rate In Maine It’s pretty fascinating to see the growth rate over the past several years. state weighted average mill rate 2022 equalized tax rate derived by dividing 2022 municipal commitment by 2024 state. The county’s average effective property tax rate is 1.65%. estimated full value property tax (mill) rates for maine cities, towns, and plantations. As many of you probably. Highest Mill Rate In Maine.

From doorcountypulse.com

Property Taxes, Revenue Sources and How Much Your Municipality Is Worth Highest Mill Rate In Maine estimated full value property tax (mill) rates for maine cities, towns, and plantations. The county’s average effective property tax rate is 1.65%. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. It’s pretty fascinating to see the growth rate over the past several years. androscoggin county has. Highest Mill Rate In Maine.

From oceanviewblog.wordpress.com

2016 Municipal Property Tax Overview, Amounts & Mill Rate Chart Highest Mill Rate In Maine estimated full value property tax (mill) rates for maine cities, towns, and plantations. The good news the old town. Rates are for 2022 and are. the mill rate went down form 21 to 17. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. state weighted average. Highest Mill Rate In Maine.

From patch.com

16 Highest Mill Rates in Connecticut Branford, CT Patch Highest Mill Rate In Maine full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. estimated full value property tax (mill) rates for maine cities, towns, and plantations. the mill rate went down form 21 to. Highest Mill Rate In Maine.

From redding2.fyi

What is the Mill Rate? Redding Info 2 Highest Mill Rate In Maine The county’s average effective property tax rate is 1.65%. estimated full value property tax (mill) rates for maine cities, towns, and plantations. It’s pretty fascinating to see the growth rate over the past several years. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. full value tax. Highest Mill Rate In Maine.

From northlakeschool.org

4224 Referendum North Lake School District Highest Mill Rate In Maine access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town. full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. the mill rate went down form 21 to 17. Rates are for 2022 and are. state weighted average mill rate 2022. Highest Mill Rate In Maine.

From rovjok.com

analytics and mill optimisation Rovjok Highest Mill Rate In Maine full value tax rates represent tax per $1,000 of value state weighted average mill rate 2021. The county’s average effective property tax rate is 1.65%. estimated full value property tax (mill) rates for maine cities, towns, and plantations. access valuable information on maine's property tax rates and assessments with our comprehensive maine property tax table, by town.. Highest Mill Rate In Maine.